How to Avoid Capital Gains Tax When You Sell Your Fusion South Bay Townhome…..

There are a lot of reasons to buy real estate.

- You can buy with a minimal cash investment.

- Real estate tends to appreciate in value over time.

- If you occupy the property, the federal government subsidizes your housing expense with tax write-offs for mortgage interest and property taxes.

If that’s not enough incentive, consider the tax benefits you receive when you sell.

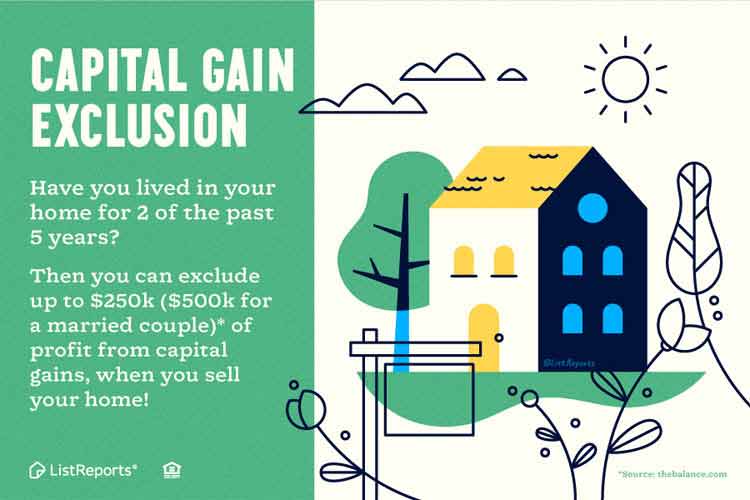

Homeowners who have owned their homes for at least two years are entitled to a capital gains tax exemption when they sell. For married couples that file jointly, the first $500,000 of gain is tax free. For single individuals, the exemption is $250,000. In either case, the property must be a primary residence that you occupied for 2 of the 5 years before selling. For a community like Fusion where home values have gone up considerably but perhaps below that threshold….there may be no capital gains tax!

The current capital gains exclusion for primary residences can be taken every two years. So conceivably you could buy a home, experience two years of appreciation, sell the property, receive tax-free gain, buy another property and repeat the sequence again and again.

The Taxpayer Relief Act of 1997 significantly changed the federal tax laws regarding the sale of a principal residence. Under the current law, you don’t need to invest in another home in order to defer capital gain liability, as was the case previously. Even if you sell your home and rent indefinitely, you’re entitled to take the $250,000 (individual) or $500,000 (married couples) capital gain tax exemption.

Contractors and renovation specialists are making good use of the current tax law. Some builders are choosing to occupy a home they’ve recently built rather than sell it new. After establishing the 2-year minimum residency

requirement, they sell the property and are eligible for the $250,000 (individual) or $500,000 (married couples) capital gain tax exemption. Home buyers with fix-up expertise can use this strategy to help build wealth. First, buy a fixer and move into it. Fix it up and live there for at least two years. Then sell, take your tax-free gain and buy another fixer. But don’t even consider this approach unless you like moving a lot and you can live comfortably in a construction zone. You’re only entitled to cash in on tax-free capital gain on the sale of your primary residence. If you own income-producing property, you must pay tax on the gain when you sell unless you complete a 1031 tax-deferred exchange. A 1031 exchangeallows you to roll gain from one income-producing property into another income-producing property. You ultimately have to paytax on the gain, but a 1031 exchange permits you to defer capital gain tax payment in the future.

IMPORTANT DISCLAIMER: Federal tax laws are in a continuous state of flux, so be sure to consult a knowledgeable tax advisor before you buy or sell, particularly if income property is involved. State tax laws vary, so consult with an expert in your area.